One day you may receive a message on your phone from MTS number 6996 with an offer to send a message for confirmation or indicate 0 to refuse. The text also indicates that the cost of such an SMS is a certain amount in rubles. If you have not made purchases online, most likely we are talking about scammers trying to debit funds from the account of a gullible subscriber through. Below we will look at what this option is, how the fraudulent scheme works, and what actions to take when receiving such a message.

What is this number 6996

First, let's figure out the MTS 6996 service, what kind of number it is, and what it is intended for. This is a business phone created to confirm and process payments. With its help, a person can make payments using a smartphone. In this case, the money is debited from the telephone balance or bank card account. To carry out transactions, you only need a phone and an Internet connection, and the rest of the actions take place automatically.

If a person has made any payments, he is unlikely to have a question about what 6996 is in MTS, because he is waiting for an SMS to confirm the transaction. In the future, the money is written off, and the operator takes a certain percentage. Using the “Easy payment” option you can carry out the following transactions:

- Payment of utility bills.

- Debt repayment.

- Making purchases at retail outlets.

- Payment for television and Internet.

- Carrying out other transactions.

Most people do not know what 6996 means in MTS, because “Easy Payment” is available by default. If the option does not work for some reason, it can be enabled in one of the following ways:

- via USSD *111*656#;

- in the MTS Personal Account;

- with the help of a call center operator;

- in the MTS showroom;

- by dialing *115#, and after confirmation by sending an SMS to number 6996 (sending 0 does not activate);

- via mobile application.

Now you have a general idea of the short number 6996 MTS and what it is. The fraudulent scheme itself deserves no less attention.

What is MTS easy payment and scammers?

But all services that somehow involve money attract the attention of scammers. So in Easy Payment they found opportunities for quick profit from gullible citizens

In the application, to log in you must enter a password, which is sent to your mobile phone. The system is standard, even large banks use this identification method, because it is impossible to hack a code that is generated randomly.

But MTS forgot to inform customers that the password should not be shared with anyone. Unfortunately, many people do not know this simple truth that access to their accounts does not need to be provided to anyone.

How does the fraudulent scheme work? The options may vary, but the basic part is always the same:

- You are contacted by a person who introduces himself as an MTS employee. The legends can be different - a certain service was activated by mistake, an account was blocked, etc. The main thing is to excite the person and report a certain problem.

- At the second stage, a solution is proposed. The person promises to set everything up and fix it, but to do this you will need to help him.

- You will receive an SMS on your phone with a code that you will be asked to give.

- Soon you will receive a notification about money transfer to an unknown number.

In reality, the scammer sends an authorization request in the application. You will receive a code on your mobile phone that provides access to your personal account. Once you name it, it's done. Now you can freely carry out transactions and transfer money.

MTS is wrong in several things:

Single phase identification

Many banks use a two-phase system, where you initially enter a permanent password and then confirm your entry with a code sent to your phone. It is important to notify clients that the password should not be shared with anyone. For example, Sberbank enters a warning text into each message. All further operations occur without a password

After authorization, fraudsters are free to make any number of transfers.

Now you know what MTS easy payment is and scammers, it’s useless to ask anyone. Here it is already necessary to act, and not waste time searching for fellow sufferers.

Who writes from number 6996

If a person orders and pays for a product/service, he has the right to choose the payment option from the operator’s balance. After some time, a message arrives from MTS from the short number 6996 indicating the amount to pay and an offer requiring confirmation of the payment. To do this, you need to send a confirmation SMS to 6996. If everything is done correctly, the transaction is confirmed. If 0 is sent, the operation is cancelled. If successful, the operator charges a certain percentage for the services, usually from 3 to 6% of the amount.

The considered scheme works as usual when a person has made a purchase or used a service. Otherwise, the sender is a fraudster who is trying to take advantage of a person’s gullibility and steal his money. Let's look at how this deception works below.

Are SMS from number 6996 dangerous?

To determine the level of risk, you need to understand what 6996 on MTS is and in what cases this service works. If a person made a payment online that required confirmation, everything is fine. It's a different matter if no transactions were carried out. In this case, we are talking about a fraudulent scheme.

The algorithm is like this:

- When paying for a product/service, the attacker indicates the “victim’s” phone number in the details and makes a link to “Easy Payment” in the hope of paying someone else’s bill.

- An unsuspecting person receives an SMS from number 6996 from MTS with a request to confirm the transaction and send a message to the specified phone number.

- The scammer immediately dials the “victim’s” number and asks to pass on the code that came in the SMS. There are various reasons for this request. For example, a fraudster may say that he made a mistake and now needs the combination from the message to make a payment.

- After transmitting the code, a certain amount is withdrawn from the balance and bank card towards the purchase made by the fraudster. Sometimes attackers go further and use a special virus program that itself sends an SMS with a password to the desired phone.

If you receive an SMS from number 6996, and it contains the text “Insufficient funds,” this indicates that a purchase was made for an amount exceeding the amount of money on the current balance.

There are other situations, for example, a person “catches” a virus on his computer, and to unblock it he needs to send an SMS to the number 6996. In all cases, the result is the same - the affected person loses money.

Transfer of funds via SMS

The mobile portal allows subscribers to pay for various services from the SIM card balance. But if you need to make a targeted transfer to a specific person, it is more convenient to use the SMS transfer function. It allows:

- top up the balance of any mobile phone using your SIM card;

- transfer money from SIM card to bank card.

In the first case, it will be necessary to send an SMS of the form: #transfer <amount> to the payment recipient's number. For the second option, it is convenient to use the short command *161*<bank card number><amount>#.

Important! In both cases, you will receive a message from service number 6996, which you will need to respond to to confirm the operation.

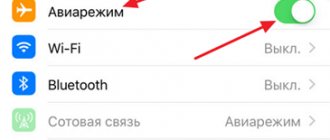

How to disable the service

Now you know what 6996 is on MTS, and what risks “Easy Payment” carries with it. To protect against scammers, you can disable the option using one of the available methods:

- Log in to the company’s personal account, click on Manage payments, and then go to the desired service. Select the Autopayments section and uncheck unnecessary items. Also, disconnect your bank card from conducting transactions.

- Dial the number 0890 and after the operator’s message, press 0 and follow the instructions.

- Go to the nearest MTS store, where you ask the employees to disable “Easy Payment”. You must have your passport with you.

- Dial *111#, and then select item 5 (Convenient communication) and press 1.

- Enter code *152*2# to block MTS number 6996.

If you decide not to disable the service, ignore the message you receive and do not take any action. Also, install a reliable antivirus program on your smartphone to protect against malware. Also check your PC for viruses and periodically change the password to your personal account in MTS (if you have one). But the most reliable way to protect yourself is to disable the Easy Payment option.

How to make payments

To use the service, just open https://pay.mts.ru/, download and install the MTS Money application. On your first visit, you must come up with a personal password consisting of unequal numbers from 4 to 8.

Attention! For security reasons, do not tell anyone your access code to the service!

If the password is entered incorrectly three times, access to the application will be blocked and all bank card data will be deleted automatically. You can recover a forgotten password in the “Settings” section, then the “Forgot your access code?” item.

If you want the latest version of the service installed on your device, update the menu. This can be done in the “Settings” section, “Update menu” item. There is no fee for the service in our country. You will receive an SMS message confirming the successful completion of the operation.

Card registration

To be able to make payments from your bank card personal account, you must register it in the application. For this:

- go to the website https://pay.mts.ru/ or open the application;

- open the “My cards” section;

- select “Add”;

- then “Entering card details”.

The number is printed on the card and is usually 16 characters long, but can range from 13 to 19 (eg 6809 6578 0221 3647). The code СVV2(CVC2) is located on the back of the card and consists of 3 digits (for example, 850). The client needs to come up with a card name consisting of a maximum of 9 characters. These can be Russian and Latin characters, as well as numbers (for example, MyCredit or 5897). Once all the required information has been entered, click the “Submit” button.

A certain amount of money will be reserved in your bank account - from 1 to 9.9 rubles, regardless of whether the bank card is registered or not. The client will need to call the bank and find out the exact amount (the bank's phone number can be found on the back of the card). Even if the card reservation operation is interrupted, this amount will be credited to the account within 15 days. The checksum must be stored on the service. To do this you need:

- go to “My cards”;

- select “Add”;

- Next is the “Confirmation” item.

After successful completion of the operation, the added card should be reflected in the “My cards” section. Once the card has connected to the service, you can make payments.

Payments from a personal bank card account

- In the “Pay” section, select the required item (for example, “Mobile phone”);

- Indicate your personal code (the client comes up with it when you first visit the service);

- Enter the required details;

- Enter the amount;

- Carefully check the correctness of the entered data;

- Click "Pay".

Payments from a mobile phone account

- Open the “Pay” section;

- Indicate your personal code (the client comes up with it when you first visit the service);

- Provide the required information;

- Enter the amount;

- Carefully check the correctness of the information provided;

- Click "Pay".

In just a few seconds you will see payment confirmation on the application screen and in a message from the operator.

Is this service necessary?

Above, we figured out what the 6996 MTS service is, why it is needed, and how it can be useful for the company’s clients. This option simplifies life in many cases and allows you to remotely make payments for housing and communal services, TV, purchases in stores, etc.

But there is also a downside to “Easy Payment” from MTS - fraud.

Attackers are increasingly taking advantage of people's gullibility and trying to steal their money. The threat can be prevented by following the tips above and not responding to suspicious messages from 9669 from MTS. As a last resort, the service can always be disabled. In any case, be vigilant, and then no one will be able to take advantage of your money. If our article helped you, please like it!

We call the operator

How to disable (MTS)? To do this, you can use a special number that allows you to easily bring your idea to life. MTS employees will quickly help you connect and disconnect any option.

To opt out of Easy Payment, you need to:

- Call 8 800 333 0890.

- Wait for an answer.

- Report your intention to refuse Easy Payment.

- Wait a while. Typically, employees ask for passport details and other information that allows the citizen to be identified.

As soon as the operator is sure that the action is being performed by the owner of a particular number, the option being studied will be disabled. A report on the processing of the request will be sent by message to the subscriber’s mobile phone literally a few minutes after the end of the call.